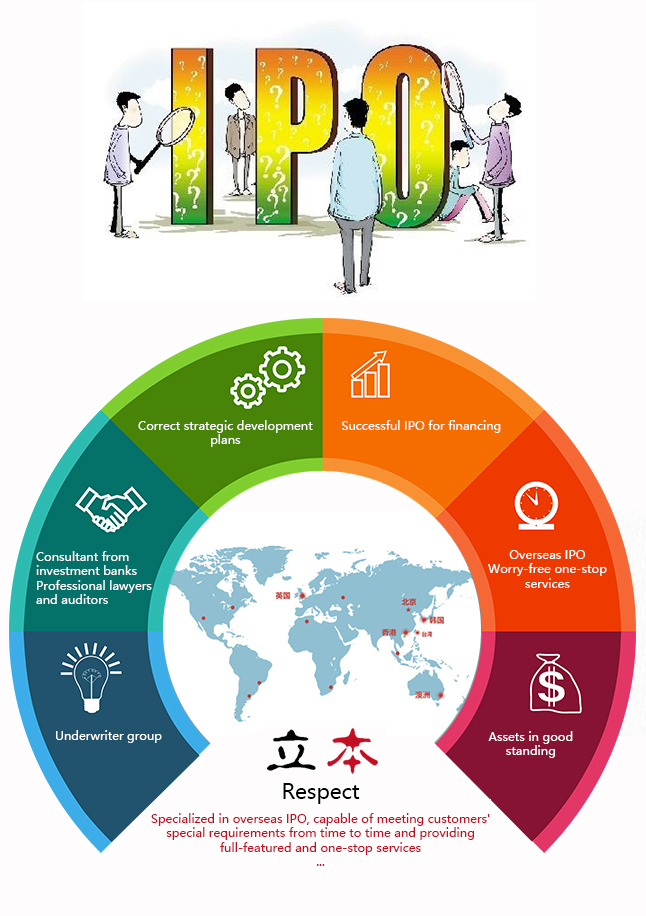

It focuses on helping Chinese enterprises to be listed in foreign securities exchange market (IPO), including South Korea, Australia, Germany, the United Kingdom, Hong Kong and other places. It provides comprehensive management of full-process and one-stop overseas IPO, committed to build an open, rich, perfect and dynamic enterprise investment and financing service group.

The Group, as the largest Chinese IPO service agency for overseas stock exchange markets, has helped more than 30 Chinese enterprises with overseas IPO and financing. The total market value of IPO clients is more than 100 billion Yuan, the amount of IPO financing more than 15 billion Yuan, and the total amount of private equity financing before and refinancing after IPO has exceeded 10 billion Yuan.

In the process of overseas IPO, we work with our partners to complete IPO feasibility analysis and planning for enterprises as well as IPO integration consultation, assets and business restructuring before IPO, financial and tax consolidation, improvement of corporate governance structure design, professional agency designation and coordination, investment research report publishing and other full-process one-stop consulting services by our professional, efficient and international elite team as well as powerful cooperation network.